Payroll & Expense Automation

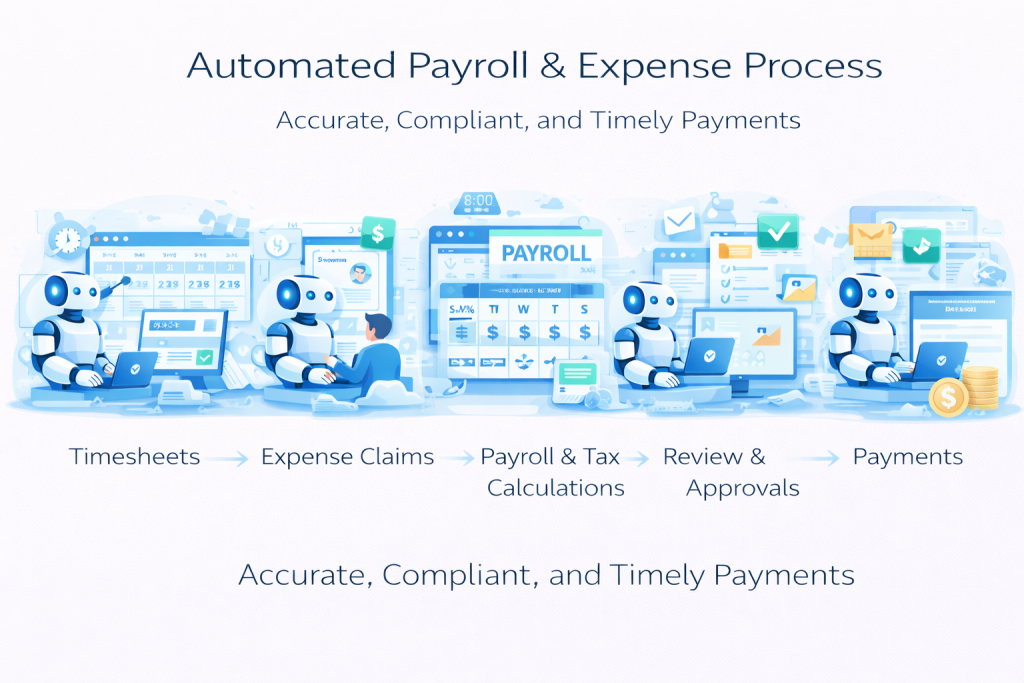

Automate payroll and expense workflows to ensure accurate payments, faster reimbursements, and full compliance — without manual spreadsheets or repetitive checks.

Payroll & Expense Automation removes the manual overhead from salary processing, expense reimbursements, approvals, and compliance checks. Ordron automates calculations, validations, approvals, and system updates so your team can focus on people — not paperwork.

What We Can Automate

- Payroll calculations and tax withholdings

- Employee expense submissions and approvals

- Reimbursements and payment processing

- Time tracking and overtime calculations

- Benefits, bonuses, and deductions handling

- Payroll data validation and reconciliation

Custom Automation Is Ideal For

- Processing payroll for salaried and hourly employees

- Automating employee expense claims and approvals

- Ensuring payroll compliance across pay cycles

- Reconciling payroll, expenses, and accounting records

- Generating audit-ready payroll and expense reports

Benefits of Payroll & Expense Automation

- Accurate Payroll Every Cycle

Eliminate manual calculation errors and missed deductions. - Faster Expense Reimbursements

Speed up approvals and payments for employee expenses. - Simplified Compliance

Automatically enforce payroll rules, tax logic, and approval controls. - Full Transparency & Audit Trails

Maintain clear records for payroll, expenses, and reimbursements. - Reduced Manual Workload

Free finance and HR teams from repetitive admin tasks.